Introduction to Convertibles

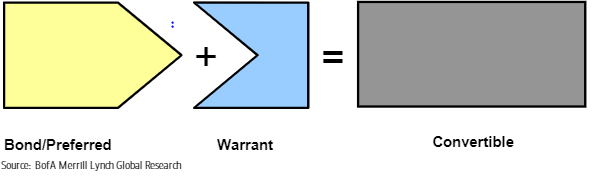

Convertible securities are either bonds or preferred equities but include an embedded call option enabling investors to redeem for a set number of common shares. By enabling conversion into common equity, convertibles provide upside potential through participation in rising stock prices.

Convertibles Structure

Unlike traditional straight/non-convertible corporate debt, convertibles contain a call option into the shares of the issuer.

This call option represents value to the investor (by offering upside participation in the equity), which therefore enables issuers to effectively reduce the coupon rate on their debt.

Due to their structural seniority to common equity, converts have often outperformed stocks in periods of elevated volatility. Owing to low relative duration (the bond component of the convert is only a part of the total convert), converts have outperformed straight debt during periods of rising rates.

The Panthera Capital Difference

Panthera’s convertibles strategy is primarily focused on balanced convertibles (typically bonds with par values of $1,000 often trading between $900 and $1,200 and with deltas of 40-80%). Panthera focuses primarily on SMID cap. companies (including in the TMT and consumer discretionary sectors, which offer relatively high growth). Panthera leverages strong security selection expertise both from a credit and equity background using a proprietary screening methodology to identify companies with both attractive credit profiles and equity valuation metrics. Panthera further identifies trading opportunties through technical analysis of the underlying equities. Finally, Panthera determines the opportune strategy to leverage the convertible including not only outright/unhedged trades but also hedged (convertible arbitrage, whereby the trader immunizes against equity risk by shorting an amount of the underlying stock sufficient to neutralize the bond against a stock decline). By leveraging a broad skill set, Panthera is uniquely positioned to realize profit potential regardless of current market conditions.

PC’s Convertibles Strategy Summary

- PC’s Strategy – focused on balanced convertibles (deltas of 40-80%) from issuers generally positioned for growth (including in the TMT and consumer discretionary sectors with small to mid-cap equtiy valuations). Portfolio credit quality targeted at B+ (as internally defined where NRSRO ratings are unavailable). A blend of outright and hedged exposure, depending on market conditions.

- Suitability – Apt for cautious investors seeking equity-like returns with less risk, plus diversification. Converts have outperformed in periods of elevated volatility & rising rates.

- Relevant Benchmarks – ICE Indices – V0A0, VTOT, V45N.

Convertibles Primer

Convertibles are exchangeable into a fixed number of the issuer’s shares based on an exercise price at a premium (above the stock price at issuance). If the stock is below the exercise price at maturity, investors redeem the bonds to the issuer for par. But when the stock price exceeds the strike price, the value of the underlying shares (conversion value) exceeds par, enabling investors to convert into common shares. Thus, converts quickly rise when the stock price exceeds the strike price.

Investors may thusly capture more of a stock’s up moves than down moves.

Convertibles are typically issued as private placements, although some securities are registered. If issued via private placement, after a seasoning period, these securities become available to the general public for investment.

Convertibles are traded over-the-counter. Liquidity is a function partly of deal size and concentration of holdings. However, relative to straight debt, convertibles typically benefit significantly from the ability to hedge the underlying equity, which typically enables a highly liquid market.