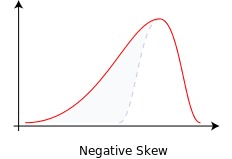

By focusing on trade structures designed to reduce “fat tail” downside distributions (or statistically abnormal losses), Panthera Capital’s objective is to minimize drawdown risk while offering disproportionate upside capture. In statistical terms, Panthera’s strategies attempt to generate negative skew (where returns are biased to the upside, with less results below the median).

When upside return capture is greater than downside risk, the return distribution is known as asymmetric. Asymmetric return profiles can be achieved by investing in derivatives or through combining different securities to form a single trade structure.

Asymmetry (also known as convexity due to the non-linearity of returns, i.e., where downside participation decreases) is typically unavailable to investors of discrete asset classes. For example, common stock investors realize the full extent of equity downside moves. Disappointing earnings results or lost customer contracts result in the equity value simply getting re-rated with shares falling accordingly. On the other hand, straight bond investors have zero upside participation in the underlying equity (aside from credit spread tightening) and are instead merely aiming to generate maximum yield per unit of risk. Furthermore, straight bonds may actually demonstrate negative convexity (price decreases when interest rates decline due to call risk, e.g. mortgage backed securities). Thus, the equity offers no downside protection and the bonds offer no upside participation.

Convertible bonds have historically demonstrated convexity. These securities are derivatives – due to the inclusion of a call option/warrant on the issuer’s stock, convertibles move in relationship to the underlying equity. The degree of sensitivity of the convert price to the underlying stock price is measured by delta (percent change in bond versus percent change in underlying equity). As convertibles are senior in the capital structure to equity (for example, bonds are subject to an indenture requiring the bonds to be repaid at par at maturity), holders can experience more upside than downside in relationship to moves in the underlying equity, i.e., convexity/asymmetry.

Similar convexity can be achieved in other asset classes, however. For example, a stock with a downside sell limit closer to the current stock price than the upside sell limit will effectively terminate the loss quicker than any gain. Similarly, protective option collars (long underlying stock, long put, short call) offers protection from downward stock moves while the short call caps gains but provides income.

Panthera Capital specializes in combining securities to construct trade structures designed to generate convexity. When combining this quantitative structuring skill set with fundamental and technical analysis, Panthera’s objective is to further generate comparatively high returns with less risk.